“Merge” games seem to be coming to the forefront, with developers potentially getting their chance to snag their share of the market. As the name suggests, “merge” games would have you combine two or more things into one as its core gameplay. It bears remembering that as much as anime/anime-style mobile games can dominate popular trends – four of them in the top 10 this Q1 2022 on Twitter – there’s many others yet that cater to different tastes.

AppMagic‘s report studies if there truly is some potential as yet untapped in the genre. Games that have merge mechanics, but aren’t exclusively Merge games, are excluded.

THE “MERGE” GENRE

To start, the Merge games are broken down into those with, and without, the metagame. The metagame affects a multitude of factors, from the initial cost of development to mechanics and player acquisition, to name a few. Merge games without a metagame are typically basic puzzles without some overarching goal and narrative, with limited progression. Conversely, metagame titles are those with increased complexity with different commercial expectations.

SIMPLE MERGE

From the graphs, simple Merge games earn next to zero IAP (in-app purchase-based) revenue but they have twice as much downloads for Merge metagame titles. It would then be reasonable to expect that any revenue would be generated from IAD (in-app ads). As it were, simple merge games are similar to “Hypercasual” games which offer a high frequency of ads with basic gameplay and no metagame. This results in a highly dynamic market with few managing to stick around. In this case, the simple Merge category will not be a highly impactful metric regarding the genre’s financial potential.

METAGAME MERGE

Even adding merely one extra element to the Merge gameplay can drastically change the overall gamefeel, as the AppMagic deep dive outlines. Merge-2 games tend to separate the core merge gameplay to the metagame, while Merge-3 “fuses” the meta into the gameplay itself. Further, Merge-3 games tend to be Merge-5, more so when “bonuses” or extra mechanics emerge when you combo more elements at once. When players are encouraged to optimize their play in Merge-3 games, play sessions also tend to become longer which then feeds into longer retention, as they become more engrossed in the complexity of the gameplay. Despite the lower total downloads for Merge-3 games, their IAP revenue is much higher than Merge-2: $7.4 vs $1.4 (worldwide) and $17.0 vs $4.2 (USA) respectively.

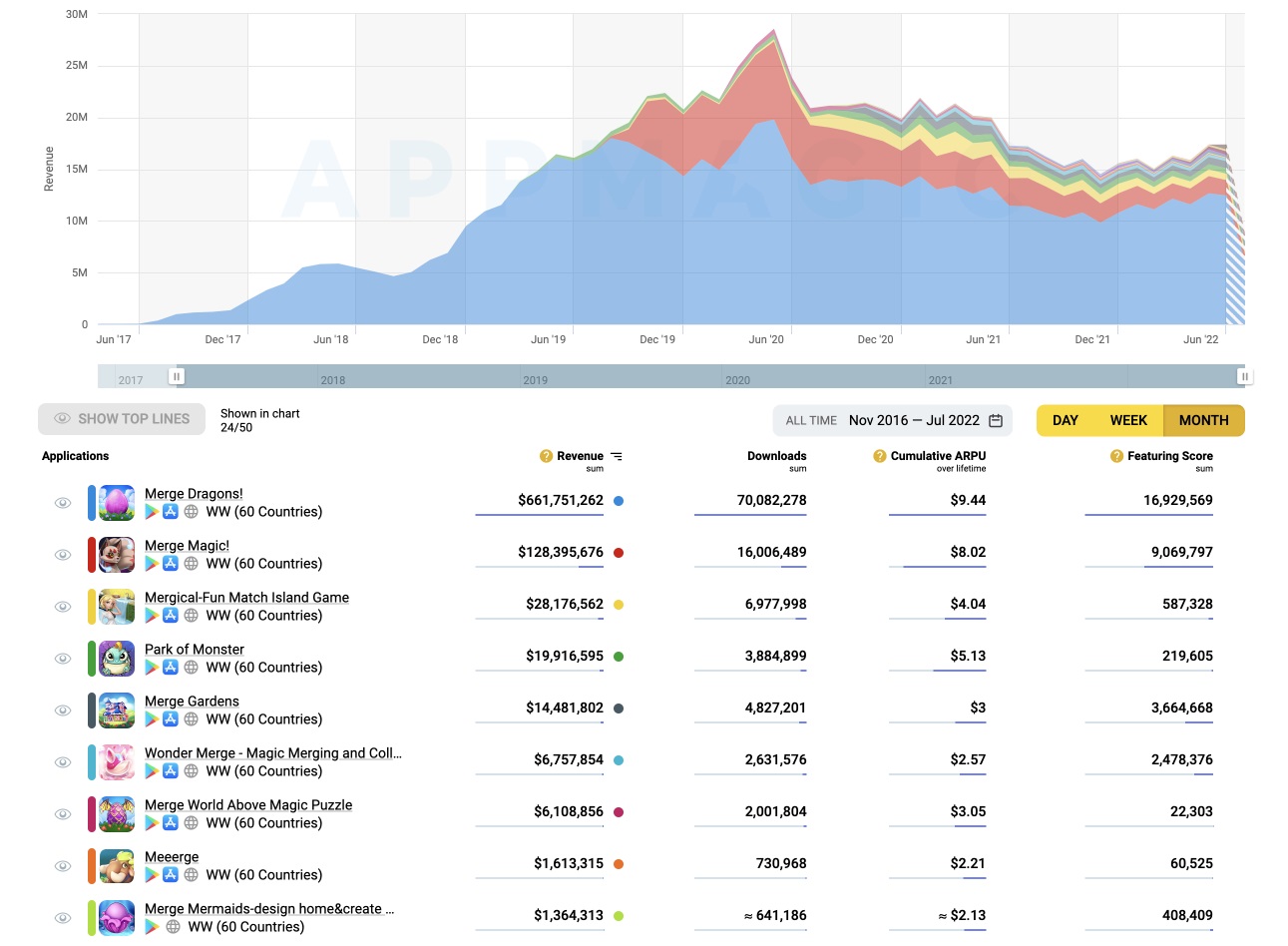

However, these figures don’t definitively determine the potential market growth for the genre. When looking at Merge Dragons! and Merge Magic! – both by Gram Games – they are two of the largest titles of the sub-genre which have been around for a while, but Gram Games’ later, similar titles did not achieve the same success. Their system involves limitations around the levels themselves with unlocks occurring through accumulation and merging of specific creatures.

Following that, the report notes Merge games similar to EverMerge being its own ‘sub-genre’, so to speak, where unlocks are done through a mix of merging and farming. The graphs show the lion’s share going to three top games, two of which emerged in the past 18 months. Merge County in particular looks to have the biggest potential, taking a risk in eschewing the typical fantasy presentation for real life and raking in the rewards. Whether the success can be replicated is another story.

How about Merge-2s? The key difference between market leaders is how they implement their task systems with AppMagic highlighting Merge Mansions and Love & Pies. Merge Mansion‘s metagame is progressed with every completed mini task. For so-called Love & Pies-likes, the metagame is progressed by having a certain amount of ‘soft currency’ earned from merging tasks.

Merge Mansion is by far the most successful of its type. Similarly to Gram Games, Metacore’s attempts at replicating Merge Mansion‘s success did not seem to hit the same highs. At the very least, it would seem that a combination of being a market pioneer and daring long-term planning can make or break a game. They still command a lead, if not repeatedly.

For Love & Pie-likes, the graphs show that diversity has more potential to succeed here. The sub-genre itself has its own advantages that can make it attractive to enter, including extremely high early retention, wide target audience and extensive viability range for the metagame. Even adding something as simple as an additional avenue of customization can give a boost.

IN CLOSING

Should the Merge genre undergo some kind of renaissance, having metagame innovations for the long term for retention would be one of those steps to pursue. There’s also the consideration of major overlap with Match-3 games with regards to CPM (cost per impression).

When planning for the long term, balancing a Merge-3 game is more than likely going to be an uphill task. Merge-2s may sound simpler on paper, but simple doesn’t mean an easier road to success. Of course, you’d also need to provide quality live-service. Being partnered with someone experienced to get you that Day 1 success will only be the beginning.

Would this mean existing games without Merge elements can try including these gameplay loops for retention? Alternatively, what about developers trying to enter the Merge game market? Much like everything else, you would need to do your own research and concepts and weigh the risk/rewards.

![[LEVEL UP KL 24] From Development to Quality Assurance: How AI is Transforming the Gaming Industry, According to Microsoft’s Jun Shimoda](https://cdn.gamerbraves.com/2024/12/Jun-Shimoda_Interview_FI-360x180.jpg)

![[CF 2024] Comic Fiesta 2024 Brings ACG Paradise to Malaysia](https://cdn.gamerbraves.com/2024/12/Comic-Fiesta-Overview_Feature_FI-350x250.jpg)

![[CF 2024] Hong Kong Comics Makes Strong Return to Comic Fiesta 2024 Following Opening Ceremony](https://cdn.gamerbraves.com/2024/12/Hong-Kong-Comics-Opening_News_FI-350x250.jpg)